Social Trading – What is it and how to start ?

Social trading is an innovative new way to invest online that combines the function of social media with online trading in the financial markets. Social trading allows the trader to copy other skilled traders and is becoming increasingly popular among traders of all backgrounds. Some traders even claim that social trading is one of the best ways to start investing in the financial markets.

Thanks to social trading, anyone with an internet connection and being registered with a social trading network can earn extra money by copying top traders automatically. Of course, the traders you choose to copy also need to perform well. If you register on a good social trading platform, it could have a big impact on your profit potential.

What Is Social Trading?

Social trading helps democratize online trading by sharing market information with less experienced traders and investors.

Social trading combining financial market and social media technology: You can subscribe and follow other traders as well as view their performance and trading data. Network traders can use this data to make more informed choices in their own trading.

There are also several forms of social trading, such as copy trading which gives the possibility of automatically copying the transactions of other traders.

Like other brokers, social trading platforms are not exempt from regulations and are tightly controlled by financial market regulators and official regulatory bodies.

How social trading works?

How it works is simple and easy. After signing up to a social trading platform, all you need to do is follow traders based on their historical performance and degree of risk-taking. Once you have chosen a trader, you can automatically replicate their investments with just one click.

However, you need to be careful when choosing a trader. Always check their historical performance and be aware of the level of risk taken by the trader to achieve these performances.

Not all brokers offer this feature, so if you are interested in social trading, you must register with a good broker that offers this feature, such as eToro.

eToro – The Best Social Trading Platform

68% of retail CFD account lose money

- eToro Fees

On eToro, the trading fees are quite low and in the average of competing brokers, but some non-trading fees can be high. This broker also charges inactivity fees but they are more or less equivalent to the average of other brokers. eToro also charges a currency conversion fee when depositing and withdrawing money from your account with currencies other than USD.

- Opening an etoro account

Opening an account on eToro is quick and easy. This broker is available in most countries except a few that we have listed below: United States, Canada, Japan, Turkey, Brazil, North Korea, Iran, Sudan, Cuba, Syria. To start trading, a minimum deposit of $ 200 is required for trading in all countries, except Israeli clients who must deposit the equivalent of $ 10,000.

- Deposit and Withdrawal on etoro

eToro offers many popular and reliable payment methods such as Paypal, Skrill, and Neteller, as well as Visa and MasterCard credit and debit cards. However, the company charges fees on withdrawals and currency conversions, and only eToro accounts in USD are available.

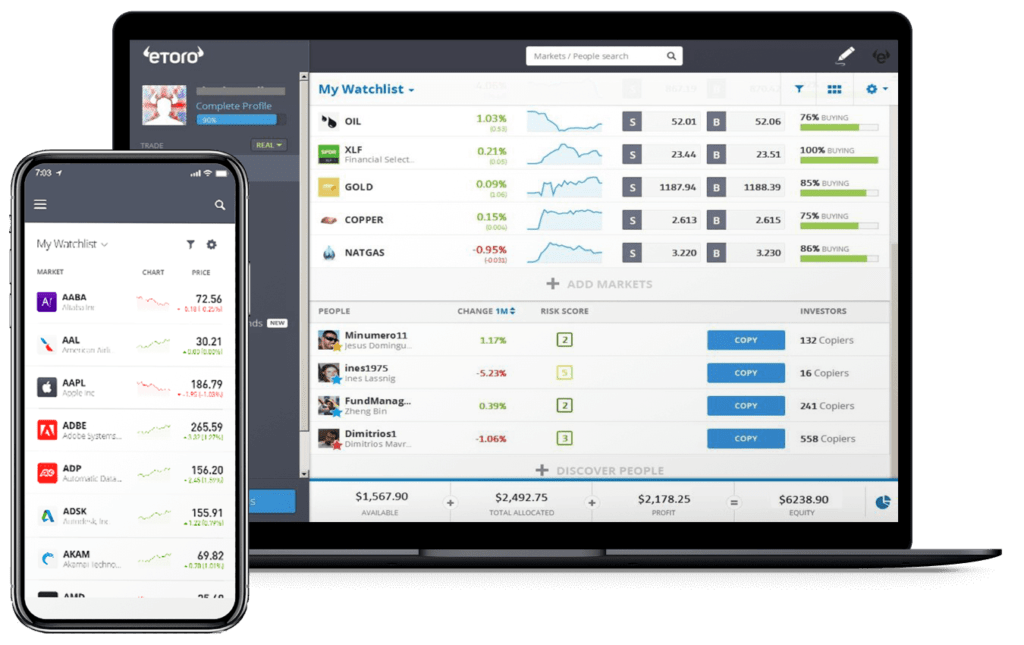

- Online trading platform

eToro has built an intuitive and very easy-to-use trading platform. The eToro platform and their mobile application are clean, modern, and are perfectly suited to the needs of expert traders as well as novice traders or those who would like to get started in online trading.

- Markets and available assets

eToro offers a variety of choices in terms of assets to trade, you can trade CFDs on stocks, ETFs, commodities, Forex, and cryptocurrencies. eToro does not only offer CFDs, It is also a multi-asset platform with which you can invest in real stocks and ETFs as well in many cryptocurrencies.

this broker also offers to their users social trading, as well as the possibility of investing in “CopyPortfolio”.

What is copy trading?

Copy trading is the act of copying someone else’s trading strategy through a copy trading platform to achieve the same performance as the copied trader. This allows the trader to automatically replicate the performance of another trader by investing in the same assets as the copied trader. The copied transactions can replicate various parameters such as the types of orders, the assets on which to invest, and the proportions of these assets in the trading portfolio.

Forex social trading

As technology advanced, many forex brokers added trading platforms that allowed clients to trade directly through the web. Today, traders can also take advantage of automated forex trading using social trading.

Social trading platforms not only offer traders the possibility to take advantage of the knowledge of other traders but also to automate trades. Below are brokers that suite best for forex social trading.

If you are looking for great social trading platform then eToro is the best trading platform. Currently, it offers the lowest spreads in the industry. This is very significant seeing that forex trading itself has incredibly high competition.

eToro is also the first forex social trading platform to offer its customers end-to-end tracking in terms of trading positions. This will give customers further incentive to make full use of the software.

eToro is also available on mobile, allowing you to access your trading account as soon as you log in. Forex trading has become extremely popular in the recent years thanks to the numerous advantages it offers. Thanks to these factors, many social trading platforms have integrated Forex trading into their platforms.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro