The 7 Best CFD Brokers

The best CFD brokers can be difficult to choose as there are so many providers. This is why in this article we will guide you in choosing your broker, and help you in selecting a serious broker who best suits your needs as a trader. Before registering on a CFD trading platform, we will give you some information that is always important to know about CFD brokers. We will explain what are CFDs, what are they used for, and the important criteria to compare to better choose your broker.

We will also talk about the regulations, the deposit and withdrawal methods available on these platforms as well as take a full tour of the best CFD brokers in the world.

| Broker | Min deposit | Leverage | MT4 | MT5 | Bonus | Regulator | website |

|---|---|---|---|---|---|---|---|

| $200 | ≤30:1 🇪🇺≤30:1 | FCA, CySEC, ASIC | Visit Broker 68% of accounts lose money |

||||

| $100 | ≤30:1 🇪🇺≤30:1 | FCA, CySEC, ASIC | Visit Broker 72% of accounts lose money |

||||

| $10 | ≤888:1 🇪🇺≤30:1 | ✔ | ✔ | $/ 25 Euro | FCA, CySEC, ASIC, DFSA, IFSC | Visit Broker 78.04% of accounts lose money |

|

| $100 | ≤400:1 🇪🇺≤30:1 | ✔ | ✔ | CBI, ASIC, FSA, FSCA, ADGM, ISA | Visit Broker | ||

| $10 | ≤30:1 🇪🇺≤30:1 | CySEC | Visit Broker 84% of accounts lose money) |

||||

| $5 | ≤1000:1 🇪🇺≤30:1 | ✔ | MFSA, LFSA, BVIFS, VFSC | Visit Broker |

Contents

Criteria for choosing a good CFD broker:

- Regulation via an official financial regulator

- Security of funds provided via segregated bank accounts

- Fair trading data and high quality charts

- Smooth and fast execution of orders;

- Reliable and secure payment and withdrawal method

- Quick withdrawal of profits

- Possibility to open a free demo account with virtual money

- Professional customer support in different languages

On this comparison of the best CFD brokers, we guarantee that the brokers who are recommended there are serious and verified. All of these brokers are endowed with strong regulations and have an excellent reputation for providing the best conditions for traders all over the world.

TOP 7 Best CFD Brokers

- eToro

- plus500

- XM

- Avatrade

- IQ option

- Deriv

- IG

eToro

Since 2007, eToro has continued to attract new traders with more than 13 million users worldwide who benefit from this innovative trading platform. eToro and known to be the number one broker in social trading, with its copy trading function. It is also a very good broker for trading cryptocurrencies and CFDs, this broker is one of our favorite brokers for crypto trading and copy trading. In addition, eToro has a simple and intuitive trading platform and a mobile application that is very suitable for beginners as well as for the most experienced trader. This broker attracts a lot of new traders, especially because it is the pioneer of Social Trading, an innovative tool that allows traders to automatically copy and replicate the transactions of other investors in the network.

eToro is a multi-asset broker for trading stocks, ETFs, forex, commodities, and cryptocurrencies. UK traders have access to the full range of assets available with the exception of crypto CFDs due to the new legal restriction that applies in the UK on CFD trading. eToro is a broker regulated by different financial market regulators including Financial Conduct Authority (FCA) and Cyprus Securities Exchange Commission (CySEC) as well as other strong official regulators. Which makes it one of the most serious brokers for CFD trading.

The advantages of eToro:

- Regulated and licensed CFD broker

- Over 3,000 assets available (CFDs, forex, stocks, ETFs, commodities and cryptocurrencies)

- Broker offering Social Trading and Copy Trading

- Free $ 100,000 demo account

- Very intuitive trading platform

- Easy to use mobile trading app

- Fast execution of transactions and high liquidity provided

- Excellent customer support by phone and email

- Safe and fast payment methods (bank transfer, PayPal, credit card, electronic wallets)

(Risk warning: 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.)

Plus500

Plus500 is one of the best CFD brokers on this list. This online brokerage company and notably listed on the London Stock Exchange. This CFD broker is regulated by reputable regulatory bodies such as the UK Financial Conduct Authority (FCA) The Cyprus Securities Exchange Commission (CySEC) and other financial market regulators such as the Australian Securities and Investments Commission (ASIC).

Plus500 is a serious and reputable CFD broker with a stock exchange listing on the FTSE, which earns it the prestige that few brokers have. Plus500 also has a highly-rated mobile application on Google Play and in the Apple App Store, which presumes their popularity among CFD traders who wish to trade on mobile. This broker has nothing to envy to the competing company and has an intuitive and easy-to-use trading platform that will suit the vast majority of professional traders as well as traders who are new to the world of online trading.

Plus 500 is a broker allowing us to speculate on a wide range of assets, among which we can find Forex currency pairs, stocks, ETFs, options, commodities as well as cryptocurrency in the form of CFDs.

The only negative point that we find is that very short-term trading strategies such as scalping are prohibited with this broker, you cannot take a position of less than 2 minutes. Also, you cannot use an automatic trading system and hedging strategy to trade with this CFD broker.

The advantages of Plus500:

- CFD broker regulated

- Access to more than 2000 assets.

- Broker listed on the London Stock Exchange

- A minimum deposit of only $ 100

- Competitive spreads and no hidden costs

- Intuitive mobile trading app

- PayPal, wire transfer, electronic wallets and other regulated payment methods

- 24/7 customer support

(Risk warning: 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.)

XM

XM is a leading broker for CFD trading which is part of the parent company Trading Point Holding, a forex and CFD broker founded in 2009. XM is regulated by three financial market regulators: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Belize International Financial Services Commission (IFSC).

XM is a CFD broker suitable for novice traders as well as more experienced traders. The main advantages of this broker are the possibility of using automatic trading strategies, the possibility of using scalping and hedging strategies, the absence of hidden costs, and fast transaction execution. This broker offers a free demo account with 100,000 USD of virtual currency to discover their offer and perfect your trading strategies.

XM offers the possibility of trading through 2 different trading platforms via real and demo accounts. MetaTrader 4, which is a very popular trading platform for trading forex as well as the MetaTrader 5 platform also offers access to forex as well as different assets like stocks, stock indices, and precious metals. These two platforms are also compatible with IOS and Android devices, which will allow you to have access to the market on mobile.

This broker offers a wide range of assets to trade with no less than 1000 assets that can be traded with the MT4 / MT5 trading platform, among which you will find Forex currency pairs, CFDs on stocks, CFDs on stock market indices, commodity CFDs, metal CFDs, and energy CFDs. Overall, XM is a versatile online broker offering a brokerage service that will suit traders of all skill levels. Whether you are a newbie trader or a pro trader looking for a reliable and trusted broker, XM is without doubt one of the best options on the market.

The advantages of XM:

- Regulated CFD broker

- Free $ 100,000 demo account

- Minimum deposit of only $ 5

- Competitive spreads from 0.6 pips

- Micro trading accounts

- More than 1,000 Trading Instruments

- MT4 / MT5 trading platform

- Automatic trading strategies allowed

- Scalping an Hedging allowed

- Personal support

- Live-webinars and analysis

(Risk warning: 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.)

Avatrade

AvaTrade is a CFD broker regulated by 6 regulators and allows you to trade no less than 1250 assets. This broker offers traders all over the world the opportunity to trade with a popular trading platform like Metatrader 4. This broker is surely one of the best for trading in excellent condition thanks to low fees, high speed of trading, fast order execution, multiple account types, tight spreads, various popular payment methods, and more.

Avatrade is a multinational broker, with headquarters based in Dublin, Ireland, and with numerous regional offices. There are different Avatrade entities based in Dublin, Paris, Milan, Madrid, Beijing, Tokyo, and Sydney, it also has offices in South Africa, Chile, Mongolia, Nigeria and has recently opened a new center. in the United Arab Emirates.

AvaTrade will suit most traders regardless of their knowledge or experience in trading and gives them the opportunity to trade online in many markets via trading platforms on Forex pairs, Stocks, Commodities, Indices, options FX, ETFs, Bonds, and cryptocurrencies. With Avatrade, you can trade without restrictions on scalping as well as short selling. It is an STP and OTC type broker allowing rapid order execution because the quotes received from the interbank are directly connected to the market itself.

The advantages of Avatrade:

- Regulated CFD broker

- Free $ 100,000 demo account

- Minimum deposit of $ 100

- Competitive spreads from 0.9 pips

- More than 1,250 assets

- MT4 / MT5 trading platform

- STP and OTC broker

- Scalping an Hedging allowed

- 24/7 customer support

(Risk warning: Your capital can be at risk)

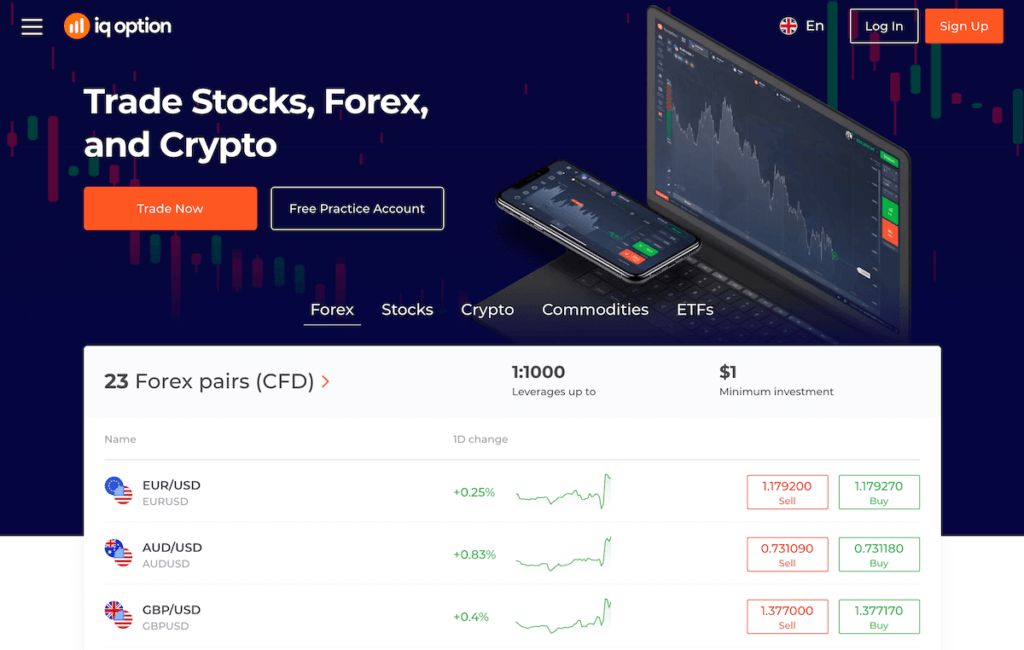

IQ Option

IQ Option started its activity as an online broker in 2013 operating under the name of the parent company IQ Option LLC. This broker allows you to speculate on a wide variety of financial instruments. IQ option offers CFDs on a wide range of underlying assets. With this broker, you can notably trade CFDs from a multitude of the market such as forex, stocks, ETFs, commodities and cryptocurrencies.

Most traders can trade CFDs with IQ Option. This broker is very popular thanks to a wide range of available assets, their intuitive and sophisticated trading platform, their low minimum deposit, and their free demo account.

MT4 or MT5 trading platforms are not compatible with this broker. However, they have developed a proprietary trading platform of excellent quality that has nothing to envy to the Metatrader platform.

The IQ Option platform is sophisticated and easy to use and has many trading tools included: multi-chart layouts, many indicators for technical analysis, economic calendars, historical quotes, volatility alerts, filters ‘actions, and market updates. The IQ Option trading platform is available in 13 languages just like those of industry leaders like eToro and Plus500.

The advantages of IQ Option:

- Intuitive and easy to use trading platform

- Minimum deposit 50 Euros

- minimum investment of only $ 1

- Wide range of Shares, ETFs, commodities, CFDs and cryptocurrencies.

- Competitive spreads

- Leverage up to 1:30

- 24/7 customer support

- Quick deposit and withdrawal

(Risk warning: CFDs are comlex instrument and comme with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money)

Deriv

Deriv.com is a new broker for online trading. On this platform, you can trade CFDs, binary options, and forex. This broker offers the possibility of trading via DTrader which is their tailor-made trading platform as well as with the MT5 platform (DMT5) and makes available an automated trading system for making your own trading bot called DBot.

This broker is regulated by various official regulatory bodies across the world. For European traders, Deriv offers brokerage services via the European branch regulated by the Malta Financial Services Authority (FSA). Traders outside the EU are served by the British Virgin Islands Financial Services Commission (FSA) and the Vanuatu Financial Services Commission (FSC). This CFD broker is also regulated by other market regulators such as the Labuan Financial Services Authority (FSA) of Malaysia.

Deriv’s trading platform DTrader is simple and sophisticated and will be suitable for traders of all levels.

This broker offers a wide range of assets including Forex, stock market indices which include the largest American, Asian, and European stocks as well as synthetic indices replicating the real-world market. This broker also allows traders to speculate on commodities as well as on energies.

On the side of leverage and margin trading, Deriv.com offers leverages of up to 1: 1000. Please note that all brokers offer maximum leverage which varies depending on your country of residence. European traders are also limited to 1:30 on leverage due to new legal restrictions that apply to retail European traders.

The advantages of Deriv:

- Multi-regulated Broker

- Trading bot and automated trading friendly

- Tight spreads

- Minimum deposit $ 10

- Leverage up to 1:1000

- 24/7 Synthetic assets to trade

- 24/7 Customer support

- Quick deposit and withdrawal

(Risk warning: Your capital can be at risk)

IG

IQ is a brokerage firm Founded in 1974 and is one of the world leaders in the brokerage of derivatives. IG (formerly IG Markets Ltd) is the first online broker to offer spread betting since 1974, and offers CFDs on many underlying assets.

IG invented spread betting in 1974. Spread betting is a derivative product like CFDs that allow you to take advantage of rising or falling market opportunities without having to buy the underlying assets. It is particularly very popular among traders from the United Kingdom and Ireland because it allows them to benefit from a tax exemption on their profits made via these derivatives.

Currently, IG is listed on the London Stock Exchange with offices based in the major financial districts of the world. This broker is regulated by many regulators and offers its services in most countries of the world, including the United States, Australia, Japan, New Zealand, Singapore as well as all European countries. .

IG offers these clients advanced trading tools, competitive and low prices and has cross-platform technology that will allow you to access the market through major trading platforms such as MT4 and MT5.

This broker offers these clients more than 16,000 markets including stocks, options, forex, indices, commodities with CFDs as well as spread betting.

The advantages of IG:

- Broker since 1974.

- Muti-Regulated Broker

- More than 16,000 markets to negotiate

- Different financial products (stocks, options, CFDs, etc.)

- Spread Betting

- Company listed on the London Stock Exchange

- Low spreads (0.6 pips) and no hidden fees

- Free demo account

- bank transfer, PayPal credit cards, for money deposit and withdrawal

(Risk warning: 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.)

What is a CFD broker?

A CFD broker is an intermediary that allows traders access to the CFD market through a trading platform. There are different brokers that allow you to trade online via CFDs on different underlying assets such as currency pairs, stocks, commodities, and cryptocurrencies.

What are CFDs?

CFDs are financial derivative products also means Contract for Difference which allow trading with leverage or margin on a wide range of underlying assets.

These instruments are derivatives mostly traded over the counter (OTC), and are used to speculate on the price movement of the underlying asset without having possession of it. Contract for Difference gives you the opportunity to make profits through the entry and exit price movements of your trades on a wide range of underlying assets.

There are many advantages for the trader to use CFDs. These derivatives give you the ability to invest and speculate on an asset’s prices up and down. you can take short positions by trading stocks with CFDs. Additionally, you can invest with very little capital and use high leverage which depends on the CFD broker you are using.

How do CFD brokers work?

CFD brokers are essential intermediaries, which give access to the market and facilitate the process of trading via an online platform. Users create an account on one of these trading platforms, deposit funds, trade CFDs on different asset classes of their choice, then withdraw their profits.

All brokers are different, offer different types of accounts, charge different fees specific to each platform. Other factors are to be considered, for example, the variety of assets available, the quality of the platforms, and the customer service.

The assets available on these platforms also vary. In general, the best brokers provide a wide range of CFD contracts in different asset classes like Forex, Stocks, ETFs, Futures, Commodities as well as Cryptocurrency.

Types of CFD brokers

CFD brokers can be divided into two categories:

Market Maker – These brokers act like trade counterparties, they buy large amounts of assets from liquidity providers and resell them directly to retail traders. They sell and buy the assets from traders who take buy and sell positions with them. These brokers have the advantage of accepting small deposits and traders with a low budget as they can easily cover liquidity gaps.

Direct Market Access (DMA) brokers – These brokers provide direct access to liquidity providers through the Electronic Communication Network (ECN).

Buy and sell orders are sent directly via the ECN, without any intervention from the broker. However, these brokers are only available to traders with more capital because these DMA providers do not intervene to cover the lack of liquidity.

Types of CFD trading accounts

Different types of trading accounts can be opened with the best CFD brokers. Some account types are more suitable for beginners while other accounts are suitable for advanced and professional traders:

- Micro Accounts – These trading accounts are perfectly suited for the novice trader, minimum deposits start at just $ 10 / $ 50.

Mini accounts – These are accounts suitable for beginners and the low budget trader, you can usually open a mini account with a deposit of $ 500. - Standard Account – These are the most popular type of account and are suitable for depositing $ 1,000 on average. This type of account usually has more bank options than higher leverage.

- VIP Accounts – These are high-end trading accounts adapted to the needs of professional traders and institutional investors, VIP accounts are accessible from a minimum deposit of $ 20,000 in funds. These types of accounts generally have more options, can offer discounts on trading fees, as well as even greater leverage available.

CFD broker regulation

It is strongly recommended to only trade with regulated CFD brokers in order to obtain protection against bad practices and scams. There are a lot of regulated brokers which allow CFDs to be traded securely in most countries of the world.

For UK clients, it is the Financial Conduct Authority (FCA) which regulates CFD brokers and imposes guidelines for the protection of clients. The FCA imposes rules on CFD trading including caps on leverage and margin trading as well as a ban on UK traders from accessing CFDs on cryptocurrencies.

The ESMA (European Securities and Markets Authority) issues recommendations to national European regulators, such as the FCA in the United Kingdom or the CySec in Cyprus.

These regulators are valid throughout the EU via the MIFID directive and apply the recommendations of ESMA. The other European regulators adhering to ESMA’s recommendations, for example, BaFin in Germany, AMF in France, FINMA in Switzerland, and PFSA in Poland.

Brokerage firms operating in Dubai are regulated by two regulatory bodies including the Central Bank of the United Arab Emirates and the Dubai Financial Services Authority (DFSA).

All of these regulators impose rules on the broker to protect their client, some of these broker offers protected CFDs. They are trading accounts with protection against negative balances, which allows the client of these brokerage firms not to lose more than what they have deposited.

In the United States, CFDs are much more restricted. However, there are platforms that accept American residents and give them access to these financial derivatives.

Before registering and opening an account with a broker, always check that your broker has valid regulations in your jurisdiction.

To conclude

CFD brokers are perfectly suited to trade different markets, whether it is Forex, Stocks, ETFs, Commodities, or Cryptocurrencies. However, each broker is unique and has different characteristics such as leverage, trading platform, and asset class preferences that differ between providers.

To begin with, the regulation of brokers is an important criterion because derivative products such as CFDs carry a high risk due to the volatility of the market and the leverage that is offered. Traders should prioritize regulated platforms with demo accounts. Traders can thus test the online trading platform without the risk associated with CFD trading and ensure that the broker is serious and has all the attributes they are looking for.